What is pip in forex

When it comes to trading in the forex market, understanding what a pip is and how it affects your trades is crucial. In order to help you grasp this concept better, we have compiled a list of 4 informative articles that will provide you with in-depth knowledge on pips in forex trading. These articles will cover everything from the definition of a pip to how to calculate its value, ensuring that you have a solid understanding of this fundamental aspect of forex trading.

The Basics of Pips in Forex Trading

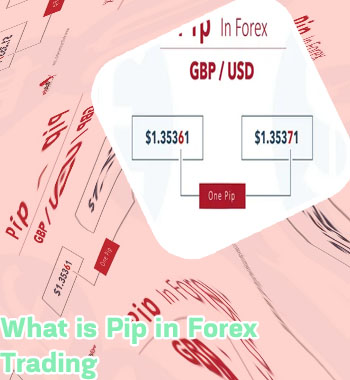

In the world of forex trading, understanding pips is crucial for any aspiring trader. A pip, which stands for "percentage in point," is the smallest unit of price movement in forex trading. It represents the fourth decimal place in currency pairs, with the exception of pairs that include the Japanese yen, where a pip is the second decimal place. For example, if the EUR/USD currency pair moves from 1.1200 to 1.1201, that is a one pip movement.

Here are some key points to keep in mind when it comes to pips in forex trading:

-

Pips determine profits and losses: As the foundation of measuring price movements, pips play a significant role in determining the profits or losses in a trade. Understanding how to calculate the value of a pip is essential for managing risk and maximizing potential gains.

-

Different currency pairs have different pip values: Since pip values vary depending on the currency pair being traded, it is important to be aware of the specific pip value for each pair. This knowledge is essential for making informed trading decisions.

-

Pips can help determine position sizes: By considering the number of pips at risk in a trade, traders can calculate the appropriate position size to maintain proper risk management. This ensures

How to Calculate the Value of a Pip in Forex

Forex trading is a popular investment option in India, with many individuals looking to profit from the fluctuations in currency exchange rates. One key concept that traders need to understand is the value of a pip, which stands for "percentage in point." A pip is the smallest price movement in a currency pair, and understanding how to calculate its value is crucial for successful trading.

To calculate the value of a pip in Forex, traders need to consider the currency pair they are trading, the size of their trade, and the current exchange rate. For example, if a trader is trading the EUR/USD currency pair and the exchange rate is 1.3000, one pip would be equal to 0.0001. If the trader is trading a standard lot size of 100,000 units, then the value of one pip would be $10.

Famous investors like George Soros and Warren Buffett have made significant profits from Forex trading, showcasing the potential of this market for generating wealth. Places like Mumbai and Delhi have vibrant Forex trading communities, with many traders actively participating in the market.

In conclusion, understanding how to calculate the value of a pip in Forex is essential for successful trading in the Indian market. By mastering this concept and applying it to their trades, investors can increase their

Understanding the Importance of Pips in Forex Trading

Forex trading is a complex and dynamic market that requires a deep understanding of various concepts and terms. One such crucial concept in forex trading is the "pip." A pip, which stands for "percentage in point," is a unit of measurement used to express the change in value between two currencies. It is typically the smallest price movement that a currency pair can make.

In the world of forex trading, pips play a vital role in determining profits and losses. For example, if the value of the EUR/USD currency pair increases from 1.2000 to 1.2010, that represents a movement of 10 pips. Traders use pips to calculate their potential gains or losses, set stop-loss orders, and determine the value of their trades.

Understanding the importance of pips in forex trading is essential for any trader looking to succeed in this highly competitive market. By knowing how to calculate pips and interpret their value, traders can make informed decisions and manage their risks effectively. Additionally, being familiar with pips allows traders to set realistic profit targets and develop sound trading strategies.

In conclusion, pips are a fundamental aspect of forex trading that every trader must grasp. By mastering the concept of pips, traders can enhance their trading skills, minimize risks

Tips for Managing Risk When Trading Pips in Forex

When it comes to trading in the foreign exchange market, commonly known as Forex, managing risk is crucial for success. One of the key aspects of risk management in Forex trading is understanding how to trade pips effectively.

Pips, or percentage in point, represent the smallest unit of price movement in Forex trading. They are essential for calculating profits and losses in the market. To effectively manage risk when trading pips, traders must set stop-loss orders to limit potential losses and take-profit orders to secure profits.

Additionally, diversifying your trades across different currency pairs can help spread risk and minimize potential losses. It is also important to use leverage cautiously, as it can magnify both profits and losses in Forex trading.

Furthermore, staying informed about market trends and economic indicators can help traders make informed decisions and mitigate risks when trading pips. By staying disciplined and following a well-thought-out trading strategy, traders can navigate the volatile Forex market more effectively.

In conclusion, managing risk when trading pips in Forex is essential for long-term success in the market. By implementing these tips and strategies, traders in India can improve their trading performance and achieve their financial goals in Forex trading.