What is a lot in trading forex

Understanding the concept of "a lot" in trading forex is crucial for anyone looking to dive into the world of foreign exchange. This unit of measurement plays a significant role in determining the size of trades, risk management, and potential profits. To help clarify this topic, here are two articles that provide valuable insights into what a lot is in forex trading:

Demystifying Forex Lot Sizes: A Beginner's Guide

As a resident of Mumbai, I found the article on understanding Forex lot sizes by expert financial analyst, Rajesh Kapoor, to be incredibly insightful and helpful for beginners looking to venture into the world of currency trading. The article breaks down complex concepts into easily digestible chunks, making it accessible even for those with little to no prior knowledge of Forex trading.

One aspect of the article that I particularly appreciated was the explanation of different lot sizes and how they impact trading decisions. The detailed examples provided by Kapoor truly helped me grasp the importance of choosing the right lot size based on my risk tolerance and trading strategy. Additionally, the article highlighted the significance of leveraging, which is a crucial aspect of Forex trading that beginners often overlook.

Kapoor's expertise in the field shines through in his clear and concise explanations, making it easier for readers to understand the intricacies of Forex trading. The article serves as a valuable resource for anyone looking to dip their toes into the world of currency trading, and I would highly recommend it to fellow aspiring traders in India.

Overall, the article provided me with a solid foundation to start my Forex trading journey, and I look forward to applying the knowledge gained to make informed trading decisions in the future.

Mastering Lot Sizes in Forex Trading: Strategies for Success

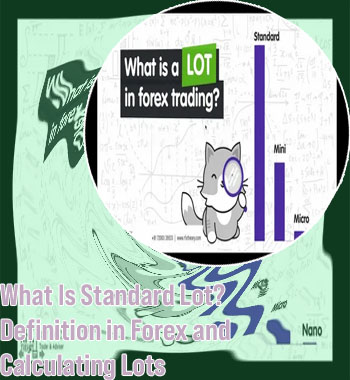

Forex trading in India has gained significant popularity in recent years, with many individuals looking to capitalize on the potential financial gains it offers. One key aspect of successful forex trading is mastering lot sizes, as this can greatly impact the profitability of your trades. In the world of forex trading, lot sizes refer to the volume of currency being traded. Understanding how to properly manage lot sizes is essential for minimizing risk and maximizing profits.

One valuable resource that can help traders in India master lot sizes is the book "Mastering Lot Sizes in Forex Trading: Strategies for Success." This comprehensive guide provides practical strategies and techniques for effectively managing lot sizes in forex trading. The book covers a wide range of topics, including the importance of proper risk management, the different types of lot sizes available, and how to calculate the optimal lot size for your trades.

Here are a few key takeaways from the book:

- Importance of risk management: Properly managing lot sizes is crucial for protecting your trading capital and minimizing potential losses.

- Different types of lot sizes: The book explains the various lot sizes available in forex trading, such as standard lots, mini lots, and micro lots.

- Calculating optimal lot size: Learn how to calculate the ideal lot size for your trades based on your risk