1 pip in forex

Understanding the concept of 1 pip in forex trading is crucial for beginners and experienced traders alike. It represents the smallest price movement in the exchange rate of a currency pair and plays a significant role in determining profit or loss. To delve deeper into this topic, here are three articles that will provide valuable insights and strategies for navigating the world of 1 pip in forex trading.

Mastering the Art of Calculating Pips in Forex Trading

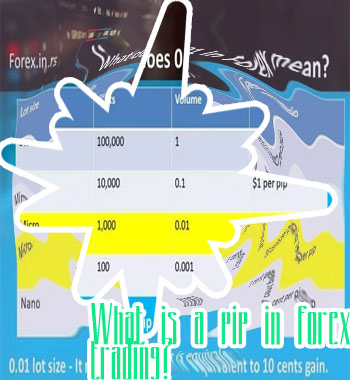

For those looking to delve into the world of forex trading, understanding how to calculate pips is essential. Pips, or percentage in point, are a unit of measurement used to express the change in value between two currencies. Mastering the art of calculating pips can help traders determine their potential profits or losses with each trade.

In forex trading, a pip is typically the fourth decimal place in a currency pair. For example, if the EUR/USD pair moves from 1.2000 to 1.2010, that represents a 10 pip movement. By knowing how to calculate pips accurately, traders can make informed decisions when entering or exiting trades.

Understanding pips is crucial for traders in India, where the forex market is rapidly growing in popularity. With the rise of online trading platforms and increased access to financial markets, more and more Indians are looking to capitalize on the opportunities presented by forex trading. By mastering the art of calculating pips, traders in India can enhance their trading strategies and potentially increase their profits.

In conclusion, learning how to calculate pips is a fundamental skill for anyone involved in forex trading, especially for traders in India. By understanding pips and their significance in the forex market, traders can make more informed decisions and improve their overall trading

Strategies for Maximizing Profits with 1 Pip in Forex

Forex trading in India can be a lucrative venture if approached with the right strategies. One such strategy is maximizing profits with just 1 pip movement in the market. A pip, short for percentage in point, represents the smallest price move that a given exchange rate can make. While it may seem insignificant, leveraging even a single pip can lead to substantial gains in the forex market.

Here are some key tips to help you maximize profits with 1 pip in forex trading:

-

Use leverage wisely: Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also magnifies losses. Therefore, it is crucial to use leverage judiciously and ensure proper risk management.

-

Focus on liquid currency pairs: Trading in highly liquid currency pairs such as EUR/USD, USD/JPY, and GBP/USD can help capitalize on even the smallest price movements. These pairs tend to have tighter spreads, making it easier to profit from small price changes.

-

Set tight stop-loss orders: To protect your profits and limit potential losses, it is essential to set tight stop-loss orders. This ensures that you exit a trade if the market moves against you by a small margin, preventing significant losses.

-

Monitor economic indicators:

Common Mistakes to Avoid When Trading 1 Pip in Forex

Interviewer: Today we have with us a seasoned Forex trader who will be sharing some valuable insights on common mistakes to avoid when trading 1 pip in Forex. Can you please introduce yourself to our readers?

Trader: Of course! My name is Raj and I have been trading in the Forex market for over 10 years now. I have learned a lot through my journey and I am excited to share some tips with your audience.

Interviewer: That's great, Raj. So, what are some common mistakes that traders make when trading just 1 pip in Forex?

Trader: One of the biggest mistakes I see traders make is being too greedy. They often try to chase after every single pip, which can lead to overtrading and ultimately, losses. It's important to have a clear strategy in place and stick to it, rather than trying to make quick profits.

Interviewer: That's a great point, Raj. Are there any other mistakes that traders should be mindful of?

Trader: Another common mistake is not using stop-loss orders. It's crucial to protect your capital and minimize losses, especially when trading such small movements like 1 pip. By setting stop-loss orders, you can prevent significant losses and trade more confidently.